JDE Peet’s debt consists of bonds, bank borrowings and leases.

JDE Peet’s debt consists of bonds, bank borrowings and leases.

Under its EUR 5 billion Debt Issuance Programme, JDE Peet’s has issued over EUR 4 billion of bonds since its first bond issuance on 16 June 2021. The proceeds were used to refinance existing bank debt facilities and for general corporate purposes. The bonds trade on the EuroMTF market of the Luxembourg Stock Exchange

US DEBT ISSUANCE

JDE Peet’s issued USD 1.75 billion of bonds on 24 September 2021. The bonds were issued under Rule 144A and Regulation-S, under the Securities Act of 1933. The proceeds were used to refinance existing bank debt facilities and for general corporate purposes. These securities are not listed on an exchange.

The bonds comprise of the following series:

REG-S ISIN |

144A ISIN |

Issue Date |

Maturity Date |

Amount (M) |

Currency |

Coupon rate |

|

USN44664AE56 |

US47216QAB95 |

24 Sept 2021 |

15 Jan 2027 |

750 |

USD |

1.375% |

|

USN44664AF22 |

US47216QAC78 |

24 Sept 2021 |

24 Sept 2031 |

500 |

USD |

2.250% |

*Qualified institutional buyers who would like to receive more information on these bonds, such as the offering memorandum and final terms, are welcome to contact one of the following financial institutions: BofA Securities, Citigroup, Deutsche Bank Securities, J.P. Morgan or Santander.

As of 31 December 2024, JDE Peet’s has no term loans outstanding.

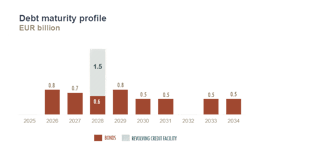

JDE Peet’s has access to a EUR 1.5 billion committed revolving credit facility, which will expire in 2028. The facility has no financial covenants and is linked to JDE Peet’s sustainability ambitions, namely the Responsible Sourcing and Minimising Footprint programmes. On 31 December 2024, the facility was undrawn.

Debt maturities and outstanding amounts can be found in the graph below.

We have had a strong track record in terms of reducing leverage following capital allocation decisions. While our leverage temporarily increased due to the acquisitions of Maratá and Caribou in 2024, our strong free cash flow generation enabled us to quickly trend back towards our optimal leverage of around 2.5x net debt to adjusted EBITDA.

An overview of our current credit ratings can be found in the table below.

Rating agency |

Long-term rating |

Outlook |

Last rating change |

| Moody's | Baa3 | Stable | 26 Apr 2021 |

| Standard & Poor’s | BBB- | Stable | 21 May 2021 |

| Fitch | BBB | Stable | 30 Mar 2023 |

Note: These credit ratings and outlook are subject to revision at any time.